“RBI…पूरी तैयारी में, banks डूबने की कगार पर, legal framework लगभग पूरा..आप भी तैयारी करिये, जरूरत के माफिक ही एकाउंट में रखे..HDFC बैंक ने पासबुक में stamp लगानी शुरू कर दी, की आपका पैसा 1 लाख तक ही insured है यानी बैंक अगर डूबती है तो आपको 1 लाख ही मिलेगा…बाकी आप खुद समझदार है, क्या आप चाहेंगे कि आपके साथ PMC जैसा कांड हो (RBI is completely prepared, on the verge of sinking, including the legal framework, you also be prepared, only deposit as per your requirement. HDFC has started putting a stamp that your money is insured till 1 lakh rupees only. You will only get 1 lakh rupees if the bank sinks. Rest, you are wise enough. Would you want that a PMC type fraud happens to you -translated)”

The above message is circulating on WhatsApp with a screenshot of a bank passbook with a stamp on it. The stamp reads, “The deposit of the banks are insured with DICGC and in case of liquidation of the bank, DICGC is liable to pay each depositor through the liquidator. The amount of his deposit upto rupees one lakh within two months from the date of the claim list from the liquidator.”

Twitter user Jitendra Ahwad posted the screenshot with the message, “*ONE LAKH ONLY is safe in private*”. He claimed that according to this document, banks are not liable to take responsibility of deposits over one lakh rupees.

HDFC BANK Using Stamp on Passbook and declaring they are not liable to take the responsibility over one Lakh….that means savings upto *ONE LAKH ONLY is safe in Private Banks* pic.twitter.com/naWjMXRcod

— Dr.Jitendra Awhad (@Awhadspeaks) October 16, 2019

FACT-CHECK

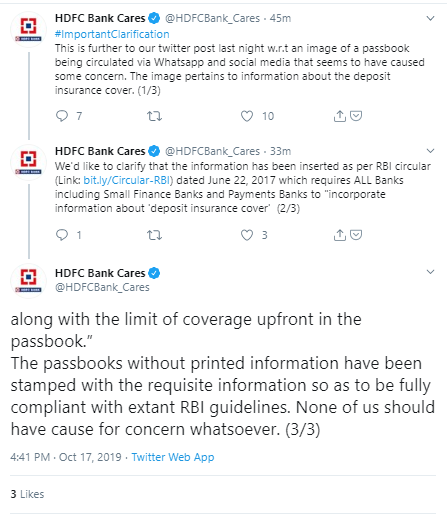

HDFC officials have reportedly said that the message was aimed at raising awareness just like a statutory declaration given for mutual funds in their commercials that they are subject to market risk. “None of us should have cause for concern whatsoever”, tweeted HDFC in a clarification thread to reassure its customers on October 17, 2019. The bank further added that the information [in form of a stamp] on the passbook has been inserted as per RBI circular dated June 22, 2017, which requires all banks including Small Finance Banks and Payments Banks to incorporate information about ‘deposit insurance cover’ along with the limit of coverage upfront in the passbook.

HDFC Bank Corporate Communication head Neeraj Jha also tweeted the statement issued by the bank. Replying to a tweet that questioned the timing of implementation, Jha clarified, “No. It’s only when the customer comes asking for a passbook. And when he does, bank has to ensure this disclosure is inserted if not already printed therein. That’s law as per RBI Circular of 22 June 2017. “

No. It’s only when the customer comes asking for a passbook. And when he does, bank has to ensure this disclosure is inserted if not already printed therein. That’s law as per RBI Circular of 22 June 2017. 😃

— Neeraj Jha (@NeerajHDFCBank) October 17, 2019

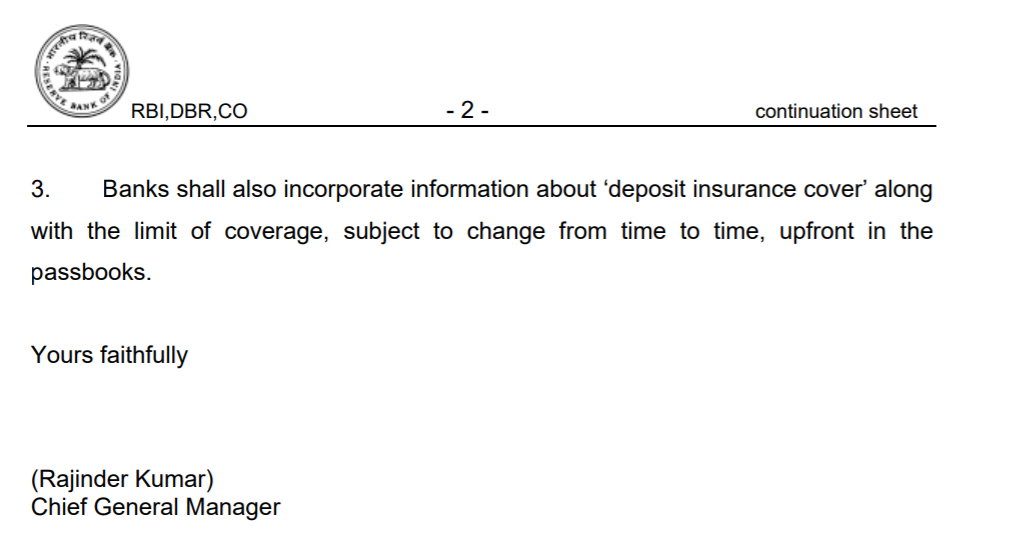

“Banks shall also incorporate information about ‘deposit insurance cover’ along with the limit of coverage, subject to change from time to time, upfront in the passbooks.”, reads the RBI circular issued on June 22, 2017. The document applies to all Scheduled Commercial Banks including Regional Rural Banks (RRBs), Small Finance Banks, and Payments Banks.

What is the deposit insurance cover?

According to RBI’s website, in 1962, India became the second country in the world after the USA to introduce deposit insurance. “Deposit insurance was seen as a measure of protection to depositors, particularly small depositors, from the risk of loss of their savings arising from bank failures. The purpose was to avoid panic and to promote greater stability and growth of the banking system – what in today’s argot are termed financial stability concerns.”, explains RBI.

A deposit insurance scheme covers banks deposits including savings, fixed and recurring with an insured bank, according to a Mint explainer published on October 16, 2019. “It is to be noted that under the current bank deposit insurance scheme in case of an unlikely bank failure deposits up to ₹1 lakh is insured and paid back to the depositor”, stated the article. The guarantee that is given to the depositor can be released only if the bank gets closed. In cases of an ongoing concern, the bank guarantee will not be released.

All the deposits maintained by the depositors across all branches of the failed bank are clubbed together. However, deposits that are maintained with different banks to be treated separately. For example, if a person has deposited money in different branches of the bank, they will be paid only Rs 1 lakh for the total amount deposited in all the branches.

These deposits are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC), which is a subsidiary of Reserve Bank of India. The agency does not charge any premium from the bank depositors but banks do pay a nominal premium for the cover.

In conclusion, it is true that deposits up to Rs 1 lakh are insured with banks. However, this is only in case a bank fails. Deposit insurance protects the depositors from losing their money in full. It ensures part recovery. So in case of a bank failure, a depositor doesn’t lose all their money. The limit was set many years ago and may not be relevant today (Considering the change in valuation of rupee across the years). The government is reportedly considering to review the deposits guarantee limit. The last revised limit came into effect on May 1, 1993, when it was increased from Rs 30,000 to Rs 1,00,000. Furthermore, this regulation that the banks have to incorporate information about ‘deposit insurance cover’ along with the limit of coverage upfront in the passbook has been in place since 2017.

Independent journalism that speaks truth to power and is free of corporate and political control is possible only when people start contributing towards the same. Please consider donating towards this endeavour to fight fake news and misinformation.