According to a message which is currently being shared on WhatsApp, nine banks in India are to be permanently shut for operations by the RBI. These banks are Corporation Bank, UCO Bank, IDBI, Bank of Maharashtra, Andhra Bank, Indian Overseas Bank, Central Bank of India, United Bank of India and Dena Bank.

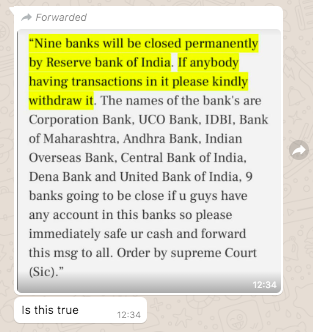

The complete text of the message is as follows:

“Nine banks will be closed permanently by Reserve bank of India. If anybody having transactions in it please kindly withdraw it. The names of the bank’s are Corporation Bank, UCO Bank, IDBI, Bank of Maharashtra, Andhra Bank, Indian Overseas Bank, Central Bank of India, Dena Bank and United Bank of India. 9 banks are going to be close if u guys have any account in this banks so please immediately safe ur cash and forward this msg to all. Order by supreme Court (Sic).”

The message stresses that this is the order of the Supreme Court, and exhorts the readers of the message to immediately safeguard their money kept in the accounts of these banks.

Alt News found the same posted by social media users on Facebook and Twitter.

Nine banks https://t.co/RYp8ItYzE1 closed permanently by @RBI if anybody having transactions in it please kindly withdraw it #HowdiModi #HowdyIndianEconomy #EconomyCrisis pic.twitter.com/S3VHDavKGP

— Adv.Shane illahi turky (@shaneilahi) September 24, 2019

Alt News has received several requests on the official app for verification of this claim.

FACT CHECK: SOCIAL MEDIA RUMOUR

There is no truth to the claim about the RBI ‘permanently closing down’ nine banks, as stated in the viral message. There are no relevant news reports in this regard. It is inconceivable that such a dramatic step, if indeed taken by the RBI, would go completely unreported.

Referring to the social media rumour, RBI itself clarified via a tweet, stating, “Reports appearing in some sections of social media about RBI closing down certain commercial banks are false.” Finance Secretary Rajeev Kumar too rubbished these rumours.

Reports appearing in some sections of social media about RBI closing down certain commercial banks are false.

— ReserveBankOfIndia (@RBI) September 25, 2019

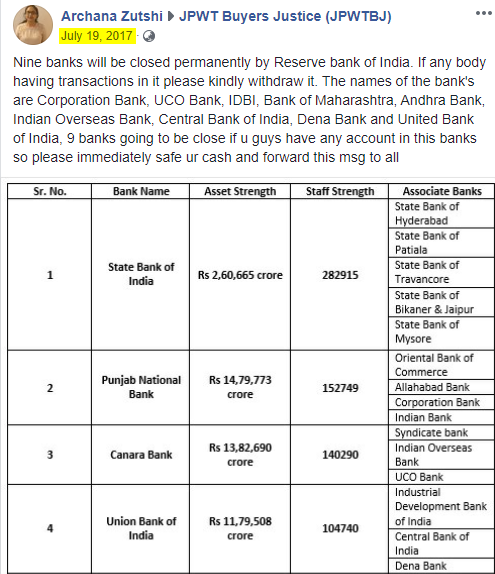

VIRAL IN 2017

Alt News found that the same message had been circulated in 2017 as well, when panicked social media users had forwarded it.

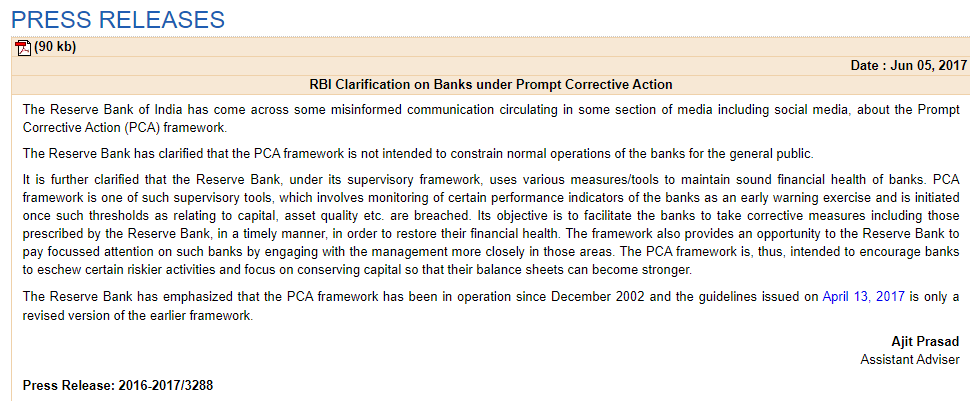

The RBI had issued a clarification in June 2017, according to which the misinformation was being circulated regarding the Prompt Corrective Action (PCA) framework of the RBI, under which these banks were placed.

Certain Public Sector Banks (PSBs) had been placed under the PCA framework owing to growth of Non-Performing Assets (NPAs) or simply put, bad loans. RBI had however categorically stated that the PCA framework did not hamper the usual operations of the banks, and that it was a set of measures intended to “facilitate the banks to take corrective measures including those prescribed by the Reserve Bank, in a timely manner, in order to restore their financial health.”

It may be noted that the social media claim about nine banks being shut down permanently by the RBI, is absolutely false. This is a rumour which has been circulating since at least 2017.

Independent journalism that speaks truth to power and is free of corporate and political control is possible only when people start contributing towards the same. Please consider donating towards this endeavour to fight fake news and misinformation.