With the 2024 Lok Sabha elections barely three months away, political parties have raised the poll pitch and gearing themselves for a high-octane campaign. The southern state of Karnataka is no exception, where in 2023, Congress won the assembly polls securing 135 seats. In the past few months, the BJP has repeatedly accused the Congress government in Karnataka of minority appeasement. Last month, the BJP heightened its criticism of Congress as anti-Hindu while alleging that on the orders of the state government, police personnel had removed a Hanuman flag from a flag post in the Keragodu village of Mandya. However, in reality, the flag post was on government land, on which only the national flag and the flag of Karnataka were permitted to be hoisted.

Now, the BJP has accused the Karnataka government of diverting money from Hindu temples to the welfare of the minority community. Along with this, BJP leaders have also alleged that the Congress government of Karnataka was appointing non-Hindus in the temple trusts by amending the Hindu Religious Institutions & Charitable Endowments Act, 1997, and taking 10% of the donations received by Hindu temples as tax. It is also claimed that according to the amendment, donations received by temples and others can also be used for the welfare of any religious community.

There are four related but distinct claims in these allegations, which Alt News will investigate in this report:

- Has the Siddaramaiah government started taxing Hindu temples?

- Is the amount collected as tax on donations to Hindu temples (10%) being used for the welfare of ‘any’ religion?

- Is money collected from Hindu temples by the Karnataka government being diverted for the welfare of minority communities?

- Has the Siddaramaiah government amended the laws and introduced a provision to appoint non-Hindus in temple trusts?

News18 anchor Rahul Shivshankar tweeted on February 16 that the Congress government in Karnataka had allocated Rs 330 crore in the Budget for the development of Waqf property, the construction of Haj Bhawan in Mangalore, and the community development for Christians. In the same tweet, he further stated that the state government pocketed an average Rs 450 crores worth of annual donations by Hindu devotees to 400 ‘A & B’ category temples.

BJP MP from Bangalore South Tejasvi Surya quote-tweeted this post, stating that the Siddaramaiah government took money from Hindu temples and was using it to fund religious institutions that were non-Hindu. He added that the money of Hindus was being used as a tool to economically enrich others.

To take money from the Hindu temples and use it to fund the religious institutions of non Hindu faiths is the standard SOP of ‘secular’ leaders like Siddharamiah.

Secularism as practiced by them is not just a stick to brow beat the Hindu, it is also a tool to financially enrich… https://t.co/rYFxSzjadv

— Tejasvi Surya (@Tejasvi_Surya) February 16, 2024

Similarly, many BJP leaders targeted the Congress government of Karnataka and accused it of appeasement of the minority community.

BJP IT cell chief Amit Malviya tweeted that the Congress government in Karnataka had amended the Hindu Religious Institutions & Charitable Endowment Bill in which a provision had been made to appoint non-Hindus to temple trusts. He also alleged the bill stated that Hindu temples would have to pay taxes on up to 10% of the amount donated. Along with this, Malviya said this amendment led to the conclusion that the funds collected by the temple could be used for anything. For example, temple funds could potentially be used to build cemetery walls.

In a shocking move, Congress Govt in Karnataka has amended the Hindu Religious Institutions and Charitable Endowment bill, allowing, among other things:

– to appoint non Hindus to Temple trust. What kind of nonsense is this? Are Hindus incapable of managing the affairs of the… pic.twitter.com/JQDNjGibp2

— Amit Malviya (@amitmalviya) February 22, 2024

Karnataka legislative assembly deputy leader Arvind Bellad tweeted that the state’s new Hindu Religious Endowments Amendment Bill was a blatant attempt by the Siddaramaiah government to seize the wealth of Hindu temples. He claimed that mandating a diversion of money into a ‘common pool’ for unspecified ‘poor and needy organisations’ was indicative of religious discrimination and fund mismanagement. Bellad added that the move weakened Hindu institutions and betrayed the trust of devotees.

Karnataka’s new Hindu Religious Endowments amendment bill is a blatant attempt by @siddaramaiah government to hijack Hindu temple funds. Mandating diversion to a ‘common pool’ for unspecified ‘poor and needy organizations’ reeks of religious discrimination and fund mismanagement.… pic.twitter.com/GQYXAJQBnU

— Arvind Bellad (@BelladArvind) February 22, 2024

Giving a statement on the issue, Union IT minister Rajeev Chandrasekhar said that Rahul Gandhi was carrying out the Bharat Jodo Yatra in the country while his party’s government in Karnataka bought the Karnataka Hindu Religious Institutions & Charitable Endowments (Amendment) Bill, 2024 in the Assembly to fund the ATMs of DK Shivakumar and Siddaramaiah. He labelled it the lowest level of appeasement politics and stated that they would oppose the bill.

#WATCH | Union minister Rajeev Chandrasekhar says, “Rahul Gandhi is holding Bharat Jodo Yatra in the country. His Congress party government in Karnataka has brought the Karnataka Hindu Religious Institutions and Charitable Endowments (Amendment) Bill, 2024 in the assembly to fund… pic.twitter.com/C5h9YV5LV3

— ANI (@ANI) February 22, 2024

Vijender Yediyurappa, son of former CM BS Yediyurappa and current BJP state president in Karnataka, also promoted this claim and called Congress anti-Hindu. Similarly, BJP leader and former Chikmagalur MLA C T Ravi, the party’s spokesperson Sambit Patra, Shahzad Poonawala, along with Right Wing handles Rishi Bagree and Megh Updates were among those who amplified the claims.

Fact Check

Did the Siddaramaiah government begin taxing Hindu temples?

The Siddaramaiah government did not, in fact, introduce the tax on Hindu temples. The Common Pool Fund was started in 2003 when the Hindu Religious Institutions & Charitable Endowments Act, 1997 came into force. In 2011, Section 17 of this law was amended and a provision was made to collect a small portion of the funds generated by high income temples to provide assistance to low income temples under the Common Pool Fund. At the time, BS Yediyurappa was the chief minister of Karnataka, representing the BJP.

- What is the Common Pool Fund?

The Common Pool Fund has been described in detail in Chapter 4 of the Hindu Religious Institutions and Charitable Endowments Act, 1997. The State Dharmarika Parishad has the power to create a common pool fund in which a small part of the income of big temples and grants received from the state government would be contributed for the maintenance of small and low income Hindu temples, and religious institutions of Hindus falling within the Muzrai department. Grants were created to build orphanages for Hindus, construction of cowsheds, the study of the Hindu religion, etc.

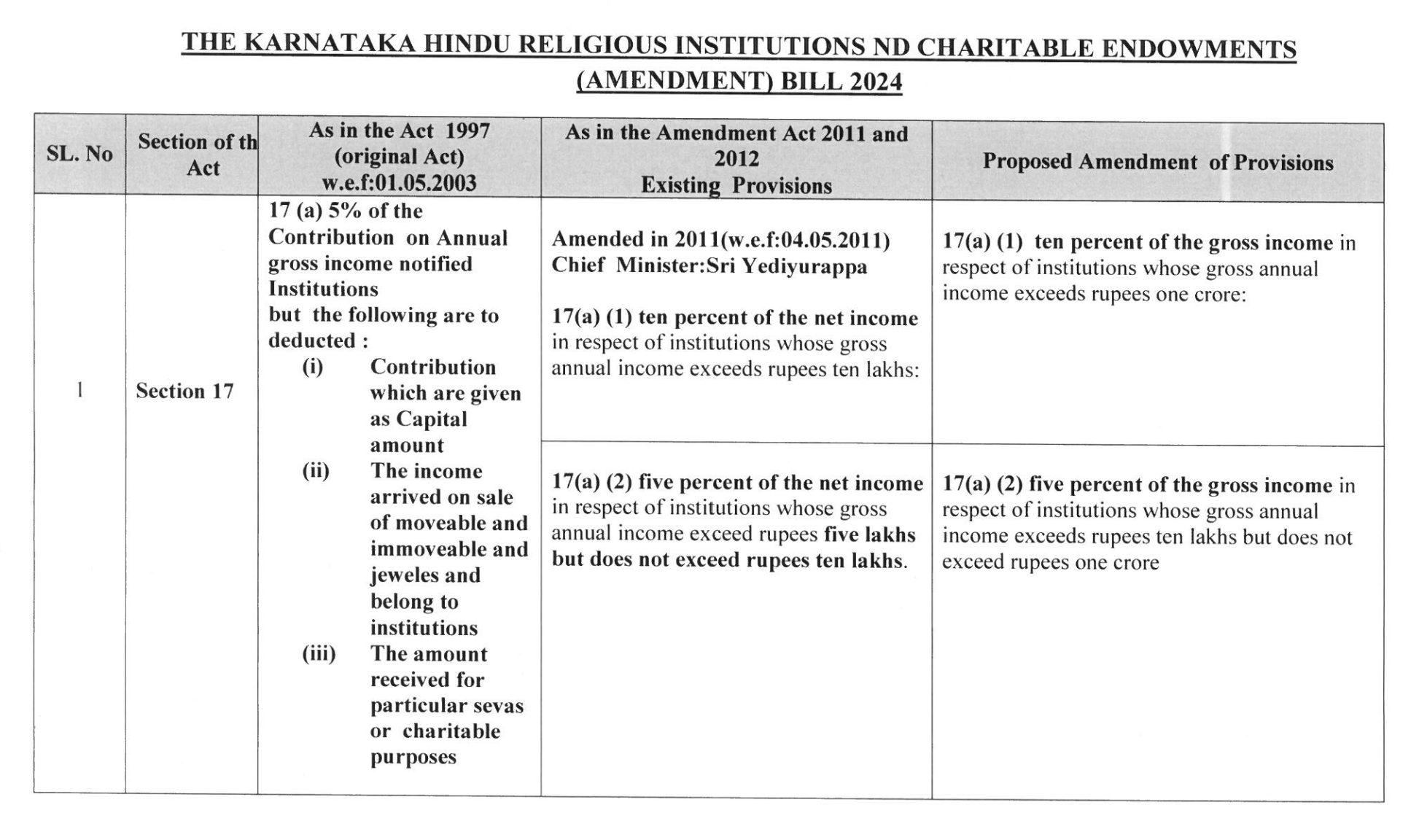

According to the amendment made in 2011, the tax rates on temples were as follows:

- 0% of the income of temples whose annual income was less than Rs 5 lakh.

- 5% of the net income of temples whose annual income exceeded Rs 5 lakh but did not exceed Rs 10 lakh.

- 10% of the net income of temples whose annual income was more than Rs 10 lakh.

According to the new amendment:

- There is no common pool fund for temples whose annual income is Rs 10 lakh.

- For temples with an annual income between Rs 10 lakh to Rs 1 crore, a total of 5% of their annual income would go to the common pool fund.

- For temples with an annual income of Rs 1 crore and above, a total of 10% would go to the common pool fund.

A source working in the Karnataka government shared a file with Alt News, which documents the past and present changes in the Karnataka Hindu Religious Institutions & Charitable Endowments Act 1997 Amendment Bill. (Complete file) It can be clearly seen from the invocation of Section 17 of this law that the Common Pool Fund had been in force since 2003, and was changed in 2011 when BJP’s B S Yediyurappa was the chief minister of Karnataka. Earlier as well, 5 to 10 percent of the total annual income of high income temples used to go to the common pool fund. In the later change, only the income band was revised.

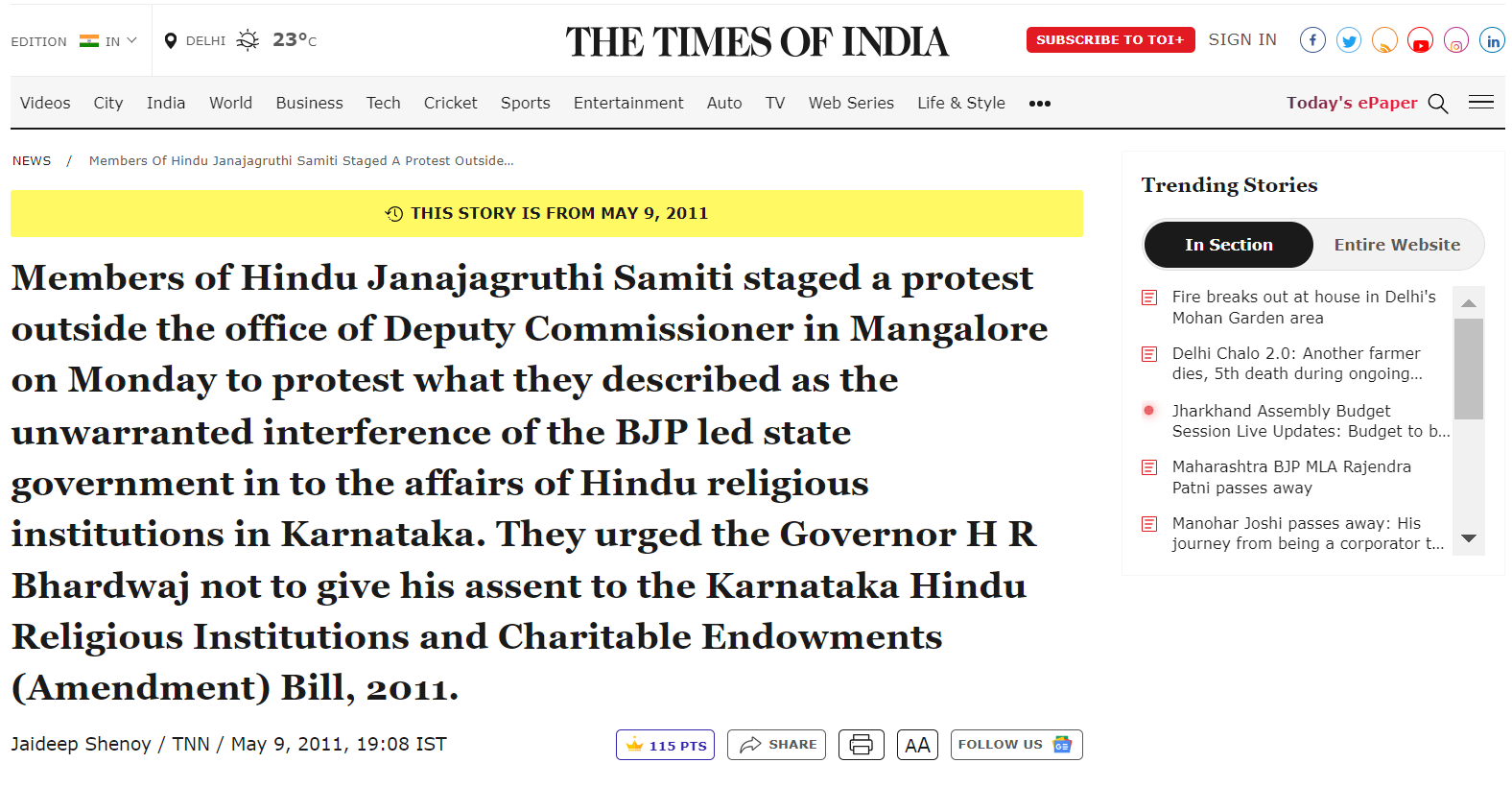

We found an article published on May 9, 2011 on The Times of India website covering how the Hindu Jan Jagruti Samiti protested against the BJP government and urged the Governor to refuse the approval of the amendment.

Is 10% of temple donations collected as tax used for the welfare of ‘any’ religion?

The 10% alleged tax which is being discussed in the viral claims is actually not a common tax collected by the government. Instead, this amount goes into the common pool fund only.

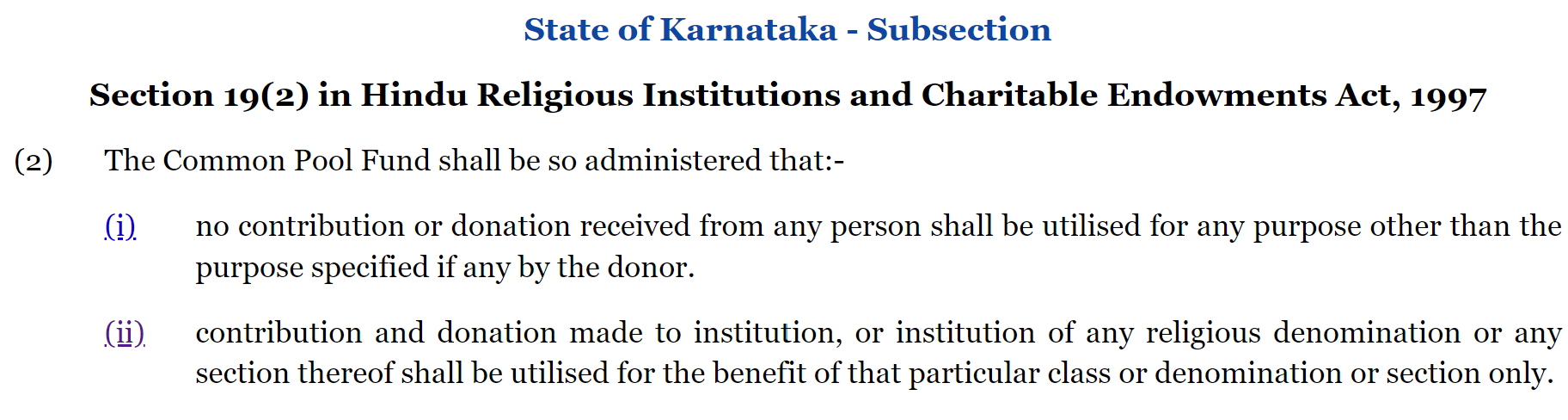

- Can the money from the Common Pool Fund be used for other religions?

No, as per Section 19(2)(ii) of the Hindu Religious Institutions & Charitable Endowments Act, 1997, the Common Pool Fund shall be so administered that contributions and donations made to any institution or institution of any religious denomination or any section would be utilized for the benefit of that particular class or denomination or section only. In other words, the money from the common pool fund of Hindu temples could be used only for the benefit of Hindus.

Is the money taken from Hindu temples by the Karnataka government being diverted to the welfare of minority communities?

Karnataka government’s Muzrai minister Ramalinga Reddy, responding to BJP MP Tejasvi Surya’s allegations, tweeted that Muzrai department money could be used only on temples and minority welfare department money could only be used on minority buildings and religious places. He insisted no money from the temples had been given to the minority welfare department. Along with this, the Muzrai minister called the viral claim false and said that the BJP and its members were experts in misleading the public.

• Money from the endowment department can only be used on temples.

• Money from the minority welfare department can only be used on minority buildings and religious places.

• No money from temples has been given to the minority welfare… https://t.co/pPje3vb5m1

— Ramalinga Reddy (@RLR_BTM) February 16, 2024

Speaking to news outlet South First, Reddy stated that the government had no control over the temples. He explained that budget funds allocated for the Muzrai Department since 2011 were entirely utilised for the development of all categories of temples falling under it. Similarly, the amount allocated in the budget for the Minority Welfare Department was used solely for religious and cultural welfare activities of minorities.

Alt News contacted Rajendra Kataria, the principal secretary to the Karnataka government’s revenue department, for more information. He stated, “There are about 35,000 temples under the Muzrai department. These temples are divided into A, B and C categories on the basis of income and property. Temples with incomes more than Rs 25 lakh are Category A, with a total of 205 temples. Temples with incomes ranging from Rs 5 to Rs 25 lakh are categorised under the B category, consisting of 193 temples. Finally, those generating an income less than Rs 5 lakh are placed in the C category, making up 34,165 temples. The government does not take money from these temples. Money from the donation boxes (Hundi) is drawn by the local committees and deposited in the bank accounts of the respective temples, which is used by the temples for their management, organising programs, development of the temple, etc. Bigger temples have a local official in whose presence the donation box is opened by the committee and this money is deposited in his account only. This money does not go to the government. The work of the Muzrai department of the government is to provide financial assistance to these temples for their development. The government also makes arrangements for the convenience of devotees, such as the opening of guest houses for pilgrims. For example, in religious sites like Tirupati, Varanasi, Srisailam, Mantralayam, and Tuljapur. Misinformation is being spread on social media that the Karnataka government takes money from Hindu temples and uses it to fund religious institutions of non-Hindu religions. A meeting of the Muzrai department has been held regarding this issue and appropriate action will be taken against those spreading such rumours.”

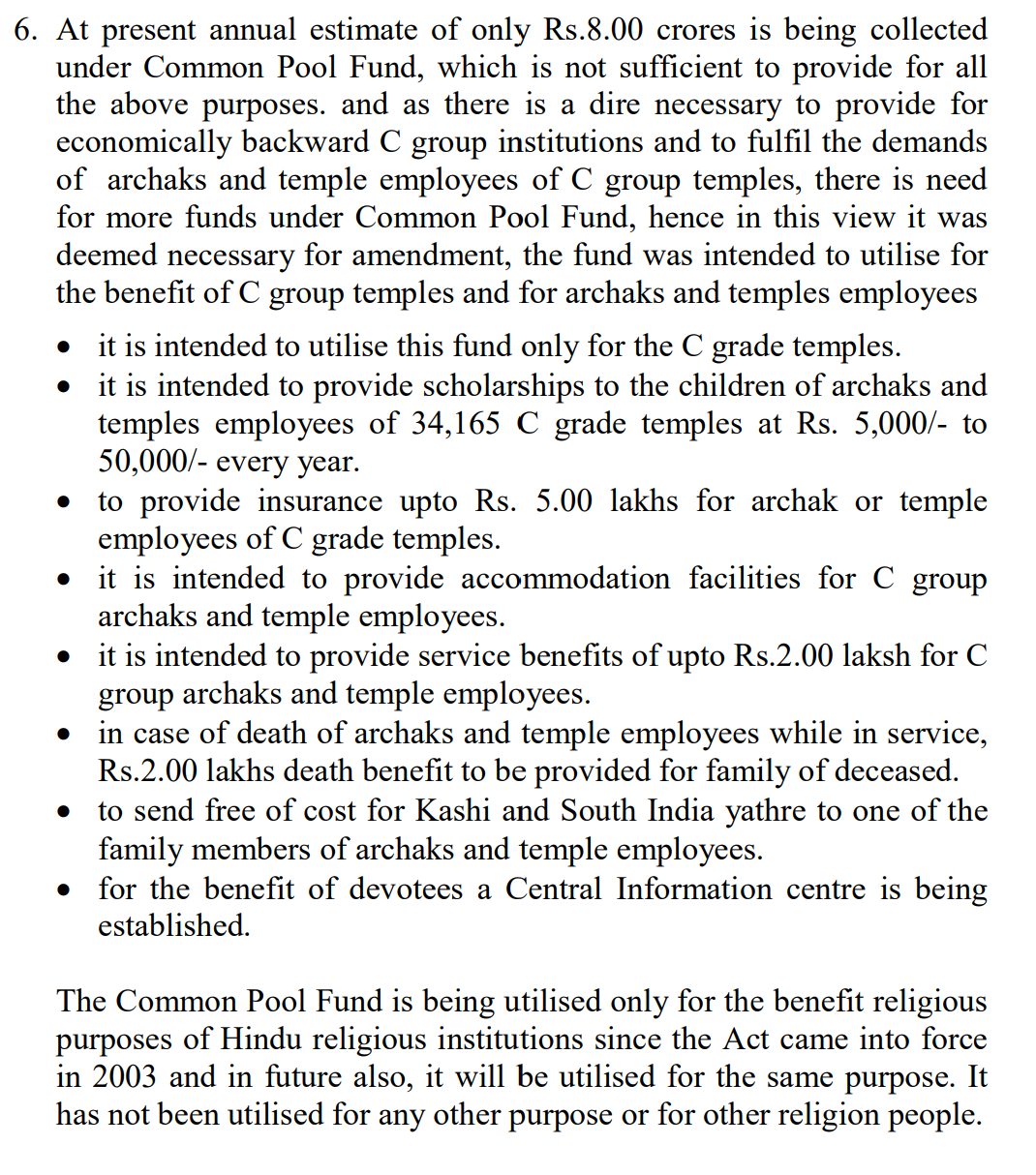

A source working in the government of Karnataka sent us a note on the Amendment Bill of Karnataka Hindu Religious Institutions and Charitable Endowments Act 1997. (Complete file) This note explains the changes related and their purpose. It is clearly written in Point 6 of this note that the Archakas and temple employees of these temples needed more money to meet the demands of economically backward C grade institutions under the Common Pool Fund. Therefore, from this point of view, it was considered necessary to revise this amount. This amount would be used only for the benefit of C Group temples along with the Archaks and employees of the temples. In addition, the note has a list of facilities to be provided to the temple employees and Archaks under the Common Pool Fund. For example, scholarship to the children of Archaks, insurance to the temple employees, accommodation facilities, free trips to Kashi and South India for the families of the temple employees, a central information center for the devotees, etc.

It is also clearly stated at the bottom of this note that since the enactment of the Act in 2003, the Common Pool Fund has been used only for Hindu religious institutions and would be used only for them in the future. It has not been used for any other purpose or for people of other religions.

News18 anchor Rahul Shivshankar, while replying to Muzrai minister Ramalinga Reddy, tweeted, “I am not saying that you are diverting the funds of Hindu temples. In fact you cannot do so as per law. What I am saying is why should any state government (even the BJP government) be in the business of using state money to develop maintain and upgrade places of places of worship of any denomination? Why should they be controlling temples?”

With great respect Sir I am not saying you are diverting funds from Hindu temples. In fact you cant do that by law @RLR_BTM. What I am saying is why should any state government (even BJP ones) be in the business of using state finances to develop, maintain or upgrade the Places… https://t.co/vXoCTtgyy0

— Rahul Shivshankar (@RShivshankar) February 16, 2024

Has the Siddaramaiah government amended the law and brought in a provision to appoint non-Hindus to the temple trust?

Alt News noticed the point highlighted by BJP IT cell chief Amit Malviya. The provision he highlighted for the appointment of non-Hindus to the temple trust had actually been enacted prior to the formation of the Congress government under present chief minister Siddaramaiah. There have been no recent changes.

- What do these lines state?

The management committee shall consist of at least one person resident in the locality where the institution is situated: Provided that in the case of a composite institution, members of both Hindu and other religions may be appointed.

- What is a composite institution?

According to the information given in point 10A of the definition of the Act, a composite institution denotes a place of worship in accordance with the customs and traditions common and jointly maintained by Hindus and other religions.

- What is the minister’s statement on this issue?

Speaking to Economic Times, Muzrai minister Ramalinga Reddy said that the viral claim about the Karnataka government introducing a provision to appoint non-Hindus to temple trusts was misleading. Only the committees of Baba Budan Giri Dargah in Chikmagalur district, Bhootrai Chowdeshwari and Saadat Ali Dargah in Shivamogga district consisted of members from both Hindu and Muslim communities because people of both the religions prayed at these places.

This bill was passed in the Karnataka assembly, but due to opposition by the BJP and JDS, it could not be passed in the legislative council.

#Karnataka #TempleTaxBill pic.twitter.com/bwtDEEkDGI

— NDTV (@ndtv) February 23, 2024

The Akhila Karnataka Archakas (Priests’) Association supported the bill in a press conference and said that small temples were short of funds. Along with this, it urged the opposition BJP to support the Congress government’s move to divert tax money from rich A grade temples to smaller temples for the uplift of 36,000 C grade temples in the state, categorized on the basis of income.

#Karnataka priests ask for the Temple Tax Bill to be passed!

Claim thousands of temples are desperate for funds. Urge opposition BJP to support Congress govt’s move in diverting tax money from rich temples, towards upliftment of 36 thousand C grade temples in state https://t.co/6UeCfF3ynB pic.twitter.com/8zYt79pzAJ

— Nabila Jamal (@nabilajamal_) February 25, 2024

At a press conference, the All Karnataka Hindu Temple Archaka (priest) Association said, “Right now, we are receiving a sum of only Rs 5,000 as our salary, which is inclusive of puja materials. No one has raised a strong voice for us like the current Muzrai minister Ramalinga Reddy. The money from the Common Pool Fund will be used only for the uplift of ‘C’ grade temples and priests. We are very happy with this decision.” The association also decided to submit a memorandum to BJP and JD(S) leaders, urging them not to oppose the amendments of the current government.

Independent journalism that speaks truth to power and is free of corporate and political control is possible only when people start contributing towards the same. Please consider donating towards this endeavour to fight fake news and misinformation.