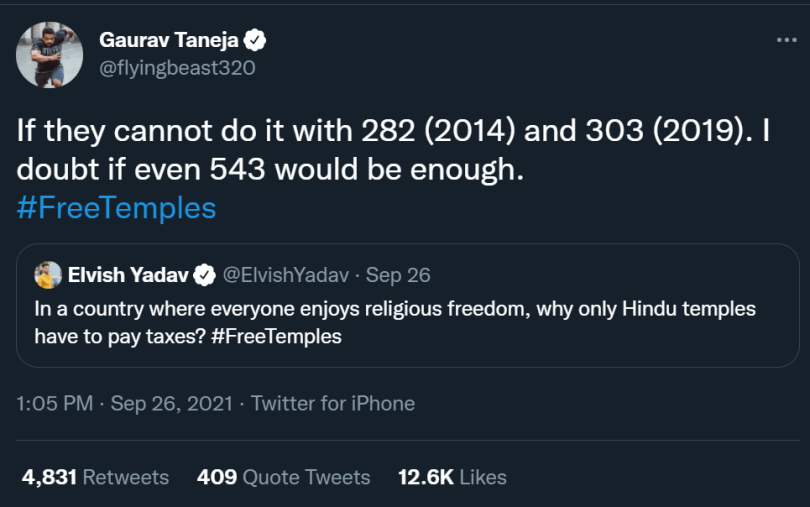

On September 26, YouTuber Elvish Yadav tweeted that only Hindu temples have to pay taxes. His post received more than 8,600 retweets as of this writing. (Archive link)

In a country where everyone enjoys religious freedom, why only Hindu temples have to pay taxes? #FreeTemples

— Elvish Yadav (@ElvishYadav) September 26, 2021

Another YouTuber Gaurav Taneja quote-tweeted Yadav’s post and wrote, “If they [BJP] cannot do it with 282 (2014) and 303 (2019), I doubt if even 543 would be enough.”

The claim is widespread on Twitter.

It is also being shared widely on Facebook.

Fact-check

Alt News had already fact-checked this claim back in 2017 when Subramanian Swamy claimed that mosques and churches were exempt from GST. The claim is false.

The Finance Ministry had also tweeted on July 3, 2017, that the claim was false. It stated that GST was not implemented on the basis of religion.

There are some messages going around in social media stating that temple trusts have to pay the GST while the churches & mosques are exempt.

— Ministry of Finance (@FinMinIndia) July 3, 2017

This is completely untrue because no distinction is made in the GST Law on any provision based on religion.

— Ministry of Finance (@FinMinIndia) July 3, 2017

We request to people at large not to start circulating such wrong messages on social media.

— Ministry of Finance (@FinMinIndia) July 3, 2017

Apart from this, Alt News had contacted a few Muslim trusts. They had informed us that they were following the new tax laws implemented in the country and also had GST certificates to show for it.

Usman H Qureshi, a member of the Qureshi Committee from Mirzapur, Ahmedabad, told us that he had received a GST registration number and was set to pay taxes as per the new laws. He shared a picture of his GST certificate with Alt News.

We also spoke to Rizwan Qadri, president of the Ahmedabad Sunni Muslim Waqf Committee (Trust). He explained that the trust owned some properties in the city, from which they received Rs. 3,00,000 as rent. Since the GST regulations contain an exemption for earnings up to Rs. 20,00,000, it was necessary for them to register their annual income. He also confirmed that he had been paying tax on the earnings of the trust even before the introduction of GST.

Explaining GST

Any organization with an annual earning of more than Rs. 40 lakh (more than Rs. 20 lakh in special circumstances) must obtain GST registration.

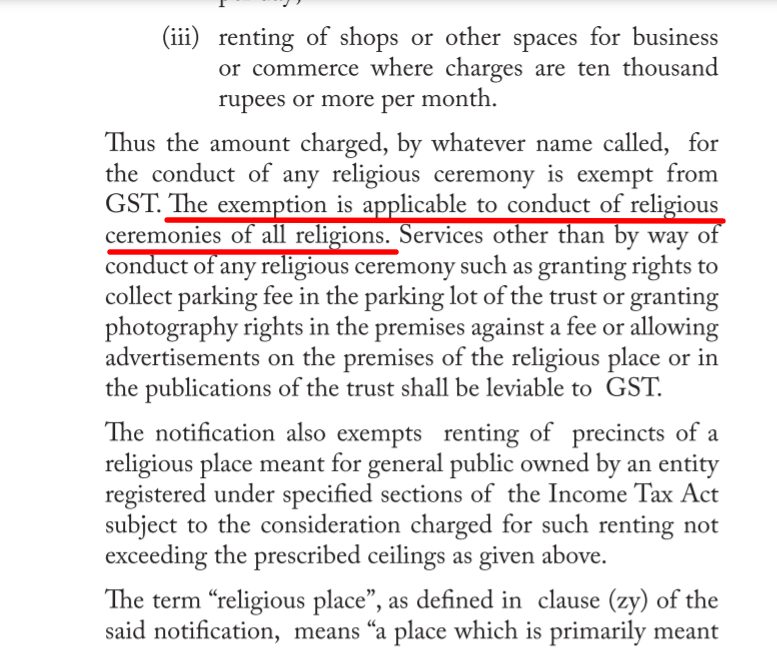

Only an entity registered under Section 12AA of the Income Tax Act, 1961 can avail of the tax exemption. The government had earlier issued a list of services the trust must provide in order to be eligible to receive a GST certificate. These services include organizing religious ceremonies, renting out the religious premises, etc. It is noteworthy that this does not include renting out the halls, open spaces, or rooms of the religious premises (with a rent of more than Rs. 1000) or any shop/place within the premises. Services provided outside this list would be covered under GST and the trust would have to pay the stipulated tax on them.

In the GST provisions regarding religious and charitable trusts, it has been clearly mentioned that religious activities from all faiths would be exempted, provided these services were part of the aforementioned list issued by the government.

The claim that only temples, and no churches or mosques, have to pay tax has been circulating online since 2017. It is completely false.

Independent journalism that speaks truth to power and is free of corporate and political control is possible only when people start contributing towards the same. Please consider donating towards this endeavour to fight fake news and misinformation.