The Ministry of Finance would like us to believe that Inflation Data shows a steady decline in general prices. To do so, they have tweeted a chart that shows consumer price inflation percentage from 2005 till Oct 2017. The tweet is factually incorrect and betrays either a complete lack of understanding of the concept of inflation or a conscious attempt to mislead the gullible.

Inflation Data shows a steady decline in general prices : pic.twitter.com/HolLLXOSur

— Ministry of Finance (@FinMinIndia) December 5, 2017

What is inflation?

The rate of inflation represents the general rate of increase in the average prices of goods and services over a period of time. A falling inflation rate means that the rate of increase in average prices has slowed down. It does not mean that prices of goods and services have fallen. Average prices are still going up, albeit the rate of increase is lower than the previous period. The ministry in its tweet has confused the falling rate of inflation with decline in prices or deflation

This faux pas did not go entirely unnoticed and was called out by many on Twitter who responded by giving the Finance Ministry account a lesson in economics.

Vivek Kaul who is the author of the ‘Easy Money’ trilogy tweeted:

The ministry of finance clearly does not understand the definition of inflation. The difference between falling prices and the fall in rate of price rise. Two very distinct things. https://t.co/ycDfcK3UMr

— Vivek (@kaul_vivek) December 6, 2017

Stanley Pignal who is the Mumbai correspondent for the ‘The Economist’ tweeted:

FYI if the blue bars are *above* the x-axis, it means general prices are increasing. So a "steady decline in general prices" this is not. https://t.co/QuwMAcetgs

— Stanley Pignal (@spignal) December 6, 2017

Another Twitter user, Nitin Pande, who is the Director of Innorenovte Solutions Pvt. Ltd., tweeted:

Inflation is rate of increase and it coming down does not mean that prices are coming down. It simply means that rate with which prices are increasing is coming down. Prices are still rising.

— Nitin Pande (@nitinpande1305) December 5, 2017

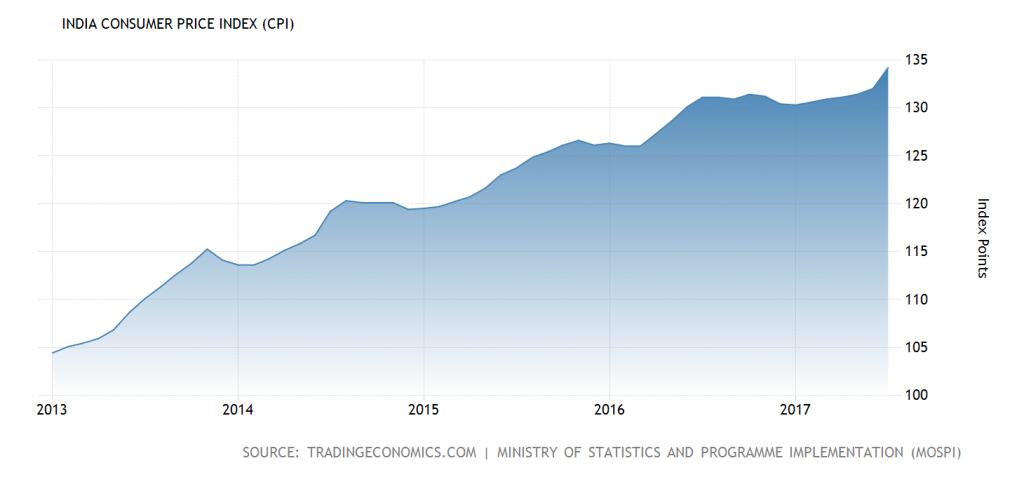

In India, inflation was calculated by RBI using the Wholesale Price Index (WPI) till 2014, after which a shift was made to Consumer Price Index (CPI). The CPI is the price of a representative basket of goods and services at the retail level that a household acquires for consumption. The items are assigned weights that are indicative of relative importance of the groups and sub-groups under which these goods and services are categorised. The CPI data is released on a monthly basis by The Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation.

Here is the Consumer Price Index chart since 2013 showing an increase in CPI over the years.

The data on the rate of inflation shared by the ministry shows that the rate of increase in prices is slowing down. As long as the inflation rate is positive, it is indicative of an increase in prices. A decline in prices will lead to a negative rate of increase or what is known as deflation.

Clearly, the Ministry of Finance in its enthusiasm to showcase the achievements of the Government has boasted of a “steady decline” in prices when it is clearly not so. Interestingly, the MoF’s claim coincides with the RBI keeping the interest rate unchanged for the second successive time over concerns of price rise owing to a spike in international crude oil prices. RBI has also raised its inflation forecast for the second half of the year from 4.2-4.6% to 4.3-4.7%.

Concepts of economics can be complicated and even esoteric, as a result of which misleading information can easily be masqueraded as accurate and conclusive data. Was this slip-up by the Ministry of Finance an instance of incompetence, a mistake or was it an attempt at sophistry? Either way, it is disconcerting to see the Ministry of Finance, an institution tasked with the responsibility of setting the fiscal policy, put out a misleading claim with regard to the economy.

Independent journalism that speaks truth to power and is free of corporate and political control is possible only when people start contributing towards the same. Please consider donating towards this endeavour to fight fake news and misinformation.